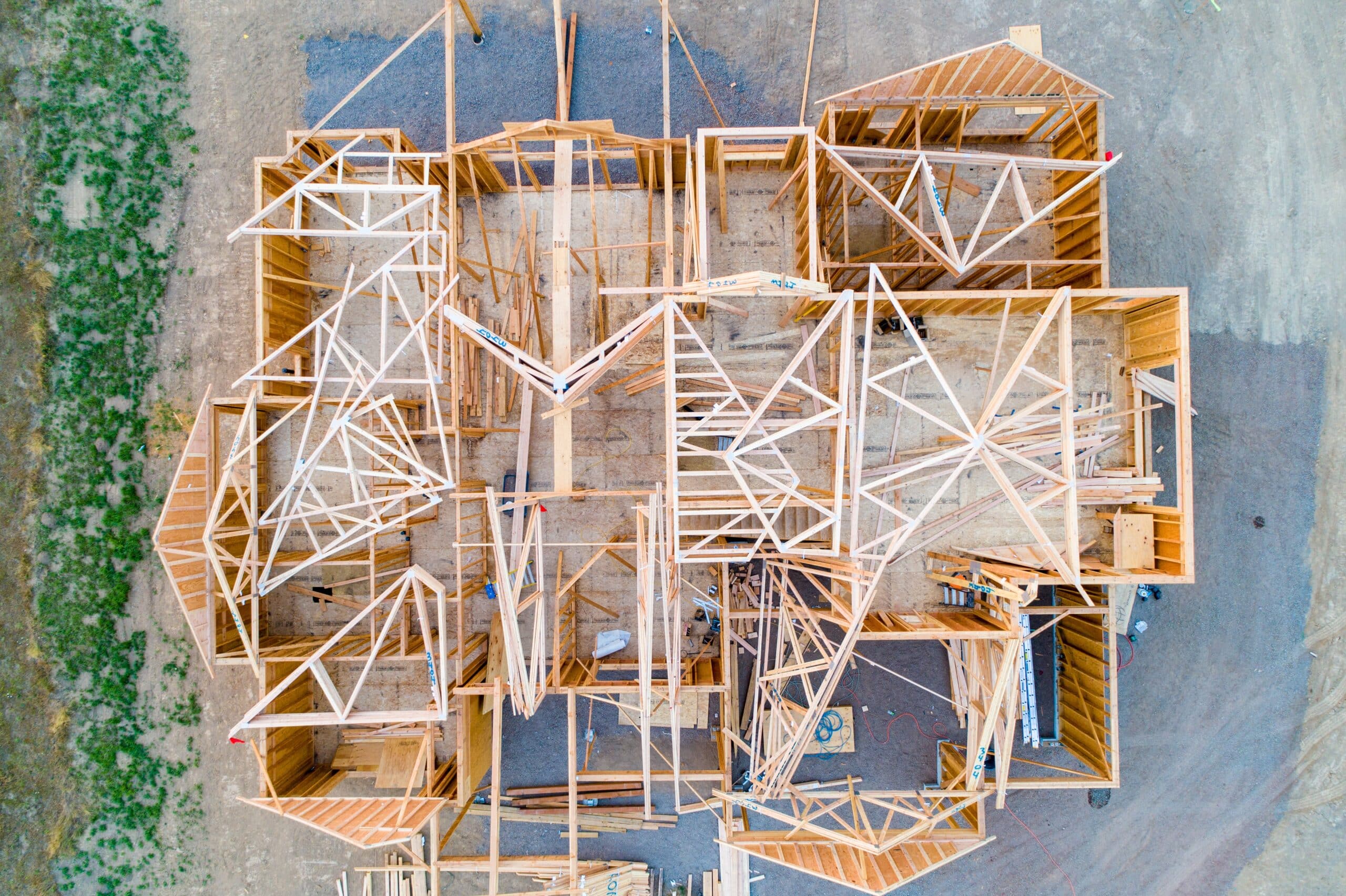

Construction Loan

Securing building financing through construction loan

A construction loan is a short-term loan used to finance the building or remodeling of a property. The loan is typically disbursed in stages as the construction progresses, and the lender will typically require periodic inspections to ensure that the work is progressing as planned. Once the construction is completed, the loan will typically convert to a permanent mortgage.

Construction Programs

Fulfill your goals with our construction loans

Bank Statement Loan

Valuable option for self-employed borrowers who may not qualify for a traditional mortgage, allowing them to demonstrate their financial stability and ability to repay the loan based on their personal or business bank statements.

Adjustable-Rate Mortgage (ARM)

With its lower initial interest rate and the potential for monthly payments to adjust with market conditions, an adjustable-rate mortgage can be a flexible and cost-effective option for financing a home.

VA Loan

Specifically designed for those who have served our country, offers favorable terms and no down payment requirement to help make the dream of homeownership a reality.

Farm Loan

Investing in the future of your farm starts with securing the right financial resources. With the right loan, you can make smart decisions that lead to growth and success.

Fixed-Rate Mortgage

A fixed-rate mortgage offers the security of knowing that your monthly payments will stay the same for the entire loan term, providing a reliable budgeting tool for homeowners.

Multifamily Loan

Investing in real estate can be a rewarding endeavor, and with the right financing in place, it’s possible to turn your dream of owning a multifamily property into a reality.

Learn More

Why working with us?

Shops all banks and lenders on your behalf

All Licensed Mortgage Advisors are trained to identify the best mortgage rate for your needs.

We speak your native language to help with the process

Our team of Mortgage Advisors speaks various languages and is always available to assist.

Service is always free of charge for borrowers

Our service and consultation will always be free of charge.

Get in touch

Call us on our mortgage dedicated number at 800-895-4136 (from Monday to Friday between 8:00 a.m. and 8:00 p.m.*) or schedule an appointment via the form.

Submit an application for preapproval

Once you’ve compiled all of the submission process and all documents have been uploaded, we’ll review your request for its feasibility and connect with you.

30+

loan advisors

80+

lenders available

300+

borrowers served

Visit the NMLS access page for more information. NMLS access page