The mortgage market is a complex and ever-changing landscape. As we navigate through 2024, a key trend that has emerged is the falling mortgage rates.

"Ready for the housing market to be impacted by low interest rates"

The Current State of Mortgage Rates

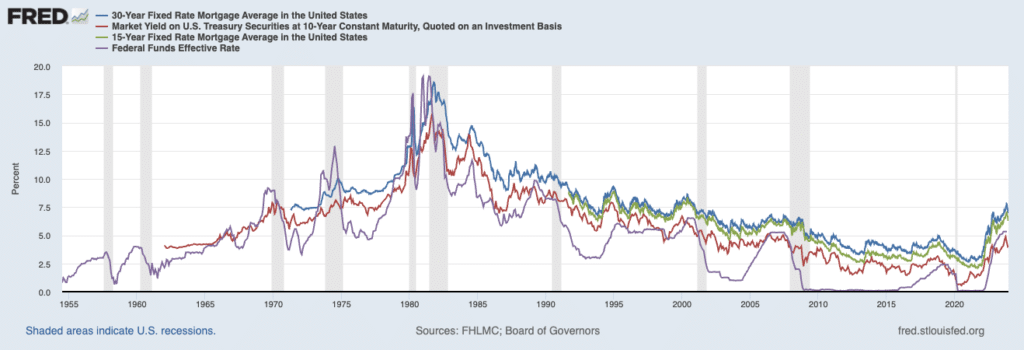

One of the most significant developments in the mortgage market has been the fall in mortgage rates. Mortgage rates have been consistently declining after an 8% peak in October. Rates are now around 7% for many borrowers, even falling into the 6% range for some. The average rate for a 30-year fixed mortgage was 7.21% last week, according to CNET’s sister site Bankrate, while Freddie Mac put the average at 6.95%, the lowest in several months.

This trend has made home ownership more affordable for many, sparking a surge in mortgage applications. However, the question on everyone’s mind is – why are the rates falling and how long will this trend continue?

The Role of the Federal Reserve in Mortgage Rates

The Federal Reserve plays a crucial role in influencing mortgage rates. It was only in 2020 when interest rates plummeted as the Federal Reserve tried to prevent the economy from crashing due to the pandemic. As of November 30, 2023, the average 30-year fixed-rate mortgage in the US was 7.66%.

The Federal Reserve paused its rate hikes in September and extended the pause just over a month later. The average 30-year, fixed-rate mortgage rate declined from nearly 8% in late October to 7.03% as of December 7, according to Freddie Mac. This decision by the Federal Reserve has been a major factor contributing to the fall in mortgage rates.

The Impact of Falling Rates on the Housing Market

The fall in mortgage rates has had a significant impact on the housing market. Lower rates mean lower monthly payments for homeowners, which can make home ownership more affordable. This has led to an increase in demand for homes, which in turn has driven up home prices in many areas.

At the same time, lower rates have also made it more attractive for homeowners to refinance their existing mortgages. Refinancing can allow homeowners to reduce their monthly payments, pay off their mortgage faster, or tap into their home equity.

Future Predictions and Their Implications

Looking ahead, experts predict that mortgage rates will continue to fall in 2024. “By the spring of 2024…rates will hopefully be in the 6% range.” This prediction is based on the Federal Reserve’s announcement that it will again leave its benchmark lending rate unchanged. The central bank has ended its two-year campaign of tightening credit and is expected to begin easing rates downward.

However, the exact timeline and extent of this fall are still uncertain. Many factors such as inflation, economic growth, and policy changes can influence mortgage rates. Therefore, prospective homebuyers and homeowners looking to refinance should keep a close eye on these developments.

Conclusion

Navigating the mortgage market in 2024 requires staying informed about these and other trends. Understanding the dynamics of falling mortgage rates can help prospective homebuyers and homeowners make informed decisions. As the situation continues to evolve, staying updated with the latest trends and developments in the mortgage market becomes increasingly important.

***Disclosure: This article is for informational purposes only and does not constitute financial, investment, or legal advice. Mortgage rates may fluctuate and decisions should be made in consultation with a professional, considering individual financial circumstances. Consult a qualified attorney to understand your rights under RESPA and other laws. Investments carry risk, including potential principal loss.

A mortgage rate is the interest charged on a home loan, which can be fixed or variable. The rates mentioned in the article refer to these interest rates. The Federal Reserve significantly influences these rates. Prospective borrowers should focus on the Annual Percentage Rate (APR), which includes the interest rate, points, and lender fees.