Fed Chair Jerome Powell suggests a pause in rate hikes to assess the economy

“Federal Reserve Chair Jerome Powell hints at possible pause in interest rate hikes while emphasizing the Fed’s commitment to bringing inflation back down to its 2% goal."

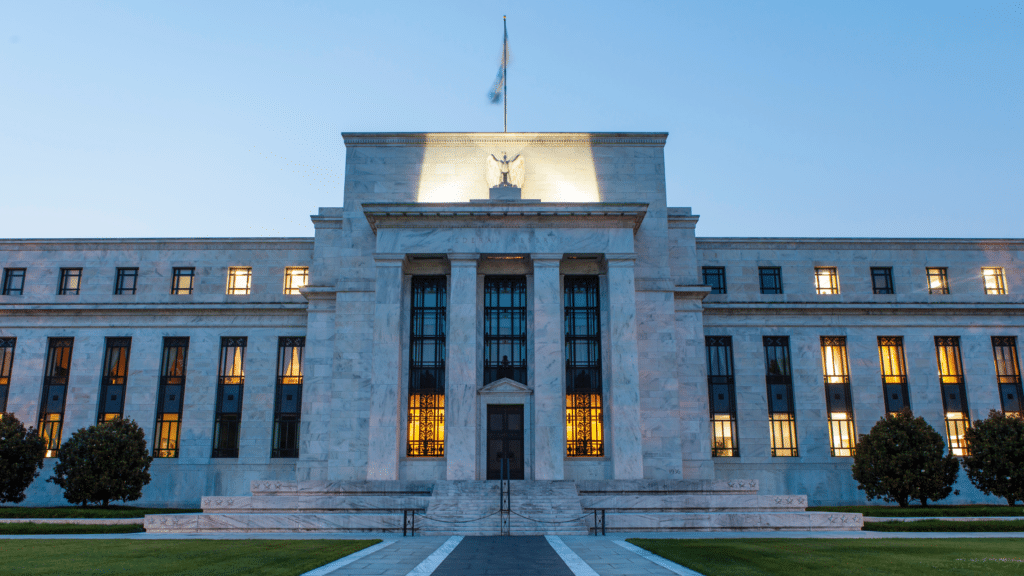

Federal Reserve Chair Jerome Powell addressed recent developments in the banking sector during a press conference on May 3, 2023. He stated that conditions in the sector have improved since early March and that the US banking system is sound and resilient. The Fed will continue to monitor conditions in the sector and is committed to preventing similar events from happening again.

As a first step in this process, the Fed released a review of its supervision and regulation of Silicon Valley Bank. The review’s findings highlight the need for changes to the Fed’s rules and supervisory practices to strengthen and increase the resilience of the banking system.

Powell emphasized that the Fed’s focus remains on its dual mandate to promote maximum employment and stable prices for the American people. He acknowledged the hardship caused by high inflation and reiterated the Fed’s commitment to bringing inflation back down to its 2 percent goal.

The Federal Open Market Committee (FOMC) raised its policy interest rate by 1/4 percentage point at its meeting. Since early last year, interest rates have been raised by a total of 5 percentage points to return inflation to 2 percent over time. The Fed is also continuing to reduce its securities holdings.

Looking ahead, Powell stated that the Fed will take a data-dependent approach in determining whether additional policy tightening is necessary. He emphasized that price stability is essential for a strong economy and labor market that benefits everyone.

In addition to these developments, Powell also hinted at a possible pause in interest rate hikes during a previous press conference. He suggested that the Fed may pause its tightening campaign in June to assess the US economy’s response to tighter credit conditions resulting from higher interest rates and recent stress in the banking sector.

Mark Zandi, chief economist for Moody’s Analytics, said that if economic data aligns with forecasts, then this could be the last rate hike. He added that the bar for further rate increases is high.

Kathy Bostjancic, chief economist for Nationwide, said that there is a moderate tightening bias but this is to be expected if the Fed is planning to pause for a while. She added that this gives the Fed flexibility if it needs to raise rates again.

The tilt toward tightening could also prevent investors from becoming too complacent about future rate hikes. This could help prevent excessive risk-taking and maintain financial stability.